Solara Active Pharma: Asymmetry in play?

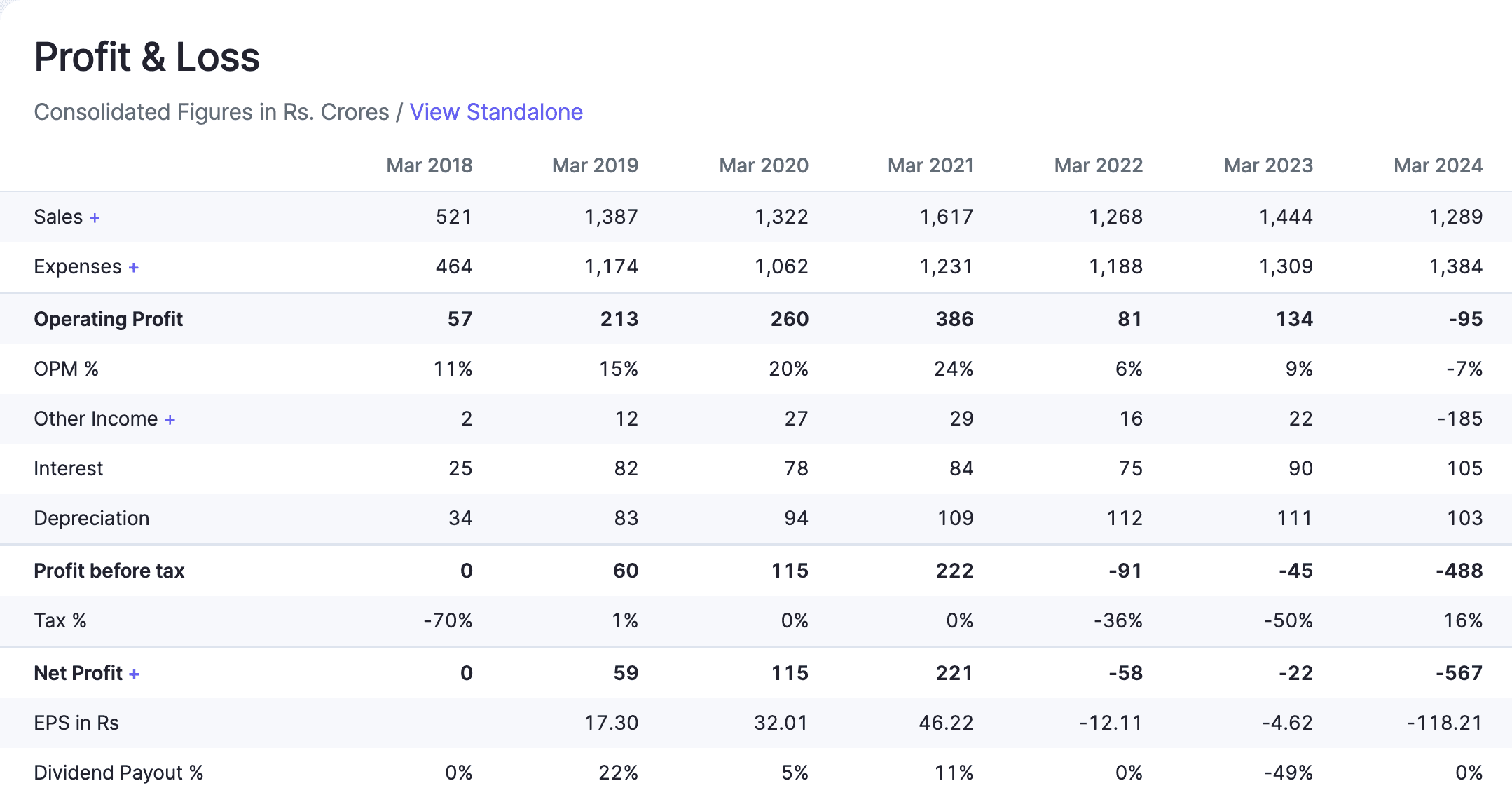

Financial markets tend to see companies in binary terms: the pristine and the damaged. With its short memory, the market rewards the pristine while discarding the damaged, failing to see that antifragility is only acquired through stress. Solara Active Pharma Sciences appears to be the definition of damaged goods. To the casual observer, it resembles roadkill - the wreckage of a company whose single-product strategy collapsed. When the Ibuprofen cycle turned in 2022, Solara’s identity shattered, leaving investors staring at a ruined balance sheet and a stock priced for permanent decline.

And that near-death experience is precisely what makes Solara interesting for me.

This is a thesis about the virtue of hitting rock bottom. The Solara of today is an exercise in corporate antifragility, a painful and deliberate re-architecting of its very DNA away from fragile, single-molecule tonnage and towards a robust, chemistry-driven platform. The market is mispricing the architecture of the future. Our opportunity lies in that gap - in recognising that the pain of 2022 was a violent, necessary beginning step in the creation of a beaut.

The One-Molecule Machine

To understand the Solara of tomorrow, you must first stare into the abyss of its past. Until 2022, Solara was a pure play Ibuprofen factory. Even now, 30%+ of its revenue is yoked to this single molecule. This concentration created a mirage of strength when pricing was good, but it was a fundamentally fragile design.

A house of cards waiting for a breeze.

The business model was a crude "push" system: chase volume at any cost, stuff the channel into less-regulated markets, and allow the balance sheet bloat. The cash conversion cycle ballooned past 300 days. The inventory turns became glacial, and we already know the rest of the story.

The subsequent collapse was the inevitable, almost Newtonian, outcome of a system designed for self-destruction. This is the cost of being a commodity player. The global Ibuprofen price, which had soared post-COVID, crashed from highs of over $18-20/kg to sub-$10/kg. Players like IOL Chemicals and Pharmaceuticals, BASF, and other Chinese manufacturers flooded the market. Solara, with its high-cost structure and bloated working capital, along with aging processes and factories, was caught offside. The channel de-stocked, and the working capital structure seized up. The market was right to punish the stock into oblivion, cleaving more than 80% from its peak valuation.

But the pivot on which this entire thesis rests is that the crisis was the catalyst. It was the corporate equivalent of a heart attack that forces a lifelong smoker to finally quit. It compelled the company to confront its addiction to commodity volume and triggered a root-and-branch overhaul of strategy, operations, and leadership. The fragility forced evolution. Isn't that by nature, antifragility?

Signaling Through the Smoke: Capital, Control, Conviction

In the art of a turnaround, spreadsheets are basically something close to fantasy. As Morgan Housel said, "More fiction has been written in Excel than in Word." I myself, although I am no seasoned investor, seldom find reason to use an excel sheet to forecast future value.

The only truth is what people with skin in the game do with their own capital, aka, expensive signalling. The most potent signals of Solara's new trajectory have nothing to do with its P&L and everything to do with the conviction of its key stakeholders.

First, the promoter's return. Arun Kumar, a respected player in the Indian pharma game, has shifted from a passive backseat role to becoming the active, vocal architect of the new strategy. The recent ₹450 crore rights issue was a re-capitalization led by the promoter group. Besides subscribing to their portion; their persistent open market buying since then is the ultimate tell. A promoter doubling down during a period of deep operational stress is the purest form of insider buying. It's a public declaration that the people with the deepest information advantage see a future the market doesn't. It cleanses the balance sheet and aligns the captains with the crew for the long, painful voyage ahead. This is exactly what strong signalling looks like.

Second, the management overhaul. The company has finally moved past a revolving door of leadership to a stable, credible team. The initial "turnaround specialist" did the initial dirty work of stabilizing the ship - rationalizing costs and staunching the cash bleed - though the Ibuprofen business remains a thorn in the side. The new leadership, led by Sandeep Rao (ex-Biocon/Viatris), brings deep commercial and operational pedigree to make it sail. The addition of Manish Gupta (ex-SeQuent) to the board is a force multiplier, importing the specific "Arun Kumar group" DNA needed to execute. After years of burning cash, the newfound discipline in working capital, bringing the cash conversion cycle down towards a sane 150-180 days, is almost jarring. It suggests the adults might finally be in charge of the asylum.

The Alchemy of Gross Margin

The Q1 FY26 numbers just dropped, the first real datapoint that isn't just narrative. And for once, it doesn't disappoint. The gross margins are holding up, expanding to the 50-55% range. This is the signal amidst the smoke that the alchemy is, in fact, working. A company dominated by generic Ibuprofen has no business posting such margins. This is a quiet revolution in the product mix.

How? The strategy is a three-pronged attack on commoditization:

Value-Added Ibuprofen: Shifting focus from plain vanilla Ibuprofen API to higher-value salts and derivatives (e.g., Ibuprofen Lysinate, Sodium Ibuprofen). These are used in faster-acting formulations, command 3-5x the price, and have stickier customer relationships. It's leveraging the core chemistry platform to move up the value chain.

Niche Chemistry Platforms: Building a quiet moat in therapeutic polymers. This is a high-barrier space, critical for controlled-release drug formulations, where Solara can be a credible "China+1" partner for Big Pharma. Scuttlebutt from the channel suggests they are one of a handful of qualified global suppliers for certain polymers.

Harvesting Sunken Costs: Reviving a portfolio of 25-30 dormant Drug Master Files (DMFs) in molecules beyond Ibuprofen. These are approved or near-approved products where the R&D is already spent. Commercializing them is low-hanging fruit, a capital-efficient way to diversify the revenue base.

This is the shift from being a price-taker to a technology partner, and the gross margin is the only number that tells that story honestly. They even turned a profit in Q1 after a long period of losses. A small one, sure, but a profit nonetheless. The operating leverage will follow as revenues scale.

The Vizag Anomaly

Solara’s Vizag facility is a paradox: a state-of-the-art, USFDA-approved behemoth that is currently "mothballed" - generating zero revenue while bleeding cash through massive under-recovery. Originally built to be a global volume leader in Ibuprofen, that thesis failed as demand slackened, leaving the asset dormant. But where the market sees a permanent write-off, I see a dormant giant being re-engineered.

Management is currently executing a structural pivot, retrofitting the facility to change its DNA from a single-product commodity plant to a "multipurpose" engine. The roadmap is relatively simple: convert one block for complex multipurpose chemistry and another for "high potent APIs," with a target to restart commercial production within the next 5 to 6 months. The ugly numbers in today’s P&L are, in my view, the temporary cost of this metamorphosis. When this facility comes back online, it will be fueling the high-margin Growth API business, as compared to low margin commodity ibuprofen. At a conservative asset turnover, this reimagined site represents a massive revenue unlock - value that is currently invisible to the screening algorithms.

Project Synthix: The Bamboo Plantation

The narrative for the demerger has also shifted. The widely anticipated demerger of the CRAMS business has been strategically paused. Management realized that mechanically stripping out the "crown jewel" while the legacy Ibuprofen business bleeds was the wrong move on the chessboard. The "bamboo" analogy for the CRAMS and Growth API business still holds perfectly. The segment is currently hitting exponential shoots with 56% gross margins and 25% EBITDA, significantly above industry averages.

However, the catalyst is no longer a spinoff, but a potential amputation of the commodity Ibuprofen limb. Arun Kumar has explicitly stated there is now "more value to retain everything in one house". By solving the Ibuprofen problem, via a strategic sale, reset, or corporate action due to be announced by Q4, Solara could transform into the high-margin, integrated CRAMS and Specialty player the market wants. My play for taking a stake here is realizing that a pure-play, high-margin scientific engine is about to emerge from the smoke, without the complexity of a split.

The Wager, The Valuation, And The Risks

Valuing Solara at this stage with conventional metrics like P/E is a fool's errand. The 'E' is currently basically nothing, suppressed by the Ibuprofen drag and the mothballed Vizag facility. The bet here is purely on asymmetry.

The Growth Engine: This is the core non-Ibuprofen business. It is already generating 56% gross margins and 25% EBITDA margins. These metrics belong to a high-quality CRAMS/Specialty player, not a commodity shop (GM and EBITDA at levels of high quality industry players. Valued at a standard 12-15x EV/EBITDA multiple for specialty pharma, this segment alone likely justifies the current market cap.

The Vizag Option: Currently, the market values this as a zero—or worse, a liability due to unabsorbed overheads. But with management retrofitting it from a single-product commodity plant to a multipurpose high-potent API facility over the next 6 months, it represents massive unseen value in capacity.

The "Ibuprofen" Put: The catalyst is no longer a demerger of CRAMS, but a strategic solution for the legacy Ibuprofen business. Whether via a sale, a partnership, or a drastic cost reset, stopping this bleed should be the event that reveals the profitable company hidden underneath.

Epistemic Humility: The Risks to the Resurrection

Of course, no investment is without peril. The ghosts of the old machine could still drag it to hell.

The "Surgical" Risk: The thesis now rests entirely on the Board's strategic review of the Ibuprofen business. If they cannot find a buyer or a viable fix for this commoditized, loss-making unit, it will continue to eat the cash flows from the healthy Growth business.

Retrofit Execution: The plan to revive the mothballed Vizag plant is ambitious. Converting a commodity block into a high-potent facility within 5-6 months. Any technical delays here will burn cash and delay operating leverage. Additionally, Solara’s tendency to have these one-off quarters as seen in the last six months will also have to stop. The market will need to see 4-8 clean consistent quarters to rerate the company as needed.

Balance Sheet Fragility: While the rights issue and internal accruals have successfully brought debt down by ~₹146 crore, with a line of sight to sub-₹500 crore levels by May 2026, the company is not yet a fortress. A prolonged downturn in CRAMS demand could resurface liquidity and inventory stress.

This is an investment in a management-led, chemistry-driven turnaround at a point of deep cyclical pessimism. I believe the market is making a classic error: pricing the entire company as a broken commodity player (the Ibuprofen legacy) while ignoring the specialty chemical engine that now drives 71% of the revenue. The combination of a deleveraging balance sheet, a clear pivot toward "One Solara" integration, and a decisive move to amputate the bleeding parts creates a setup with limited downside and non-linear upside.

I will be allocating 20% of my book to this play, with 10% additional if the stock dips below 400.

Blended Entry Price: ~478